The Message From Migrating Millionaires

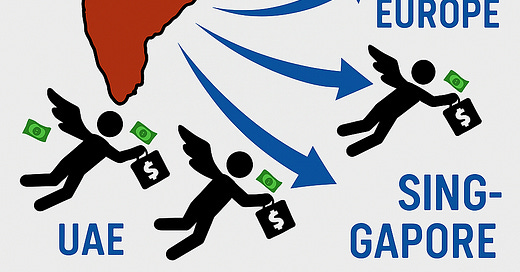

Millionaires are on the move, seeking better taxes, freedom, and living standards. What does this mass migration mean for countries like India, and how can they stop the wealth drain?

Message from migrating millionaires

Millionaires are moving countries by the tens of thousands, at an increasing pace each year, according to Henley and Partners’ annual reports on Global Wealth Migration (read the latest report Here). Some countries draw in millionaires, like a rare-earth infused permanent magnet snaps up iron filings: Singapore and the UAE, for example. Some lose their millionaires, like Britain, India and China.

It is but natural for dollar millionaires to travel across borders. They can afford to, and many do, for work and pleasure. We are not talking about millions of airmiles being clocked up, but about the wealthy changing their nationality. The reasons vary. Some millionaires from China, one of the major countries from where millionaires flee, move to breathe free. The Communist state crimps their entrepreneurial, as well as their political, freedom.

Some flee to breathe air free from pollution. Guess which country qualifies for that! Quality of schooling and other elements of the standard of living are a concern. Some flee for greater financial freedom, to experience the joys of uncontrolled cross-border capital movement. Some experience the ease of doing business a subsidiary they set up in the UAE or Singapore enjoys, and decide they want it for future ventures.

But most millionaires move to avoid paying taxes they consider to be overly burdensome. The taxes in question are personal income taxes. Tax on business can be minimized through efficient tax planning, involving the location of subsidiaries in low-tax jurisdictions. It can be tackled by adding the tax on business to other input costs to determine the pricing of the final product or service the business provides, to arrive at the desired post-tax rate of return the business owners want. Unless there are arbitrary tax breaks for some select competitors, this strategy works fine.

The Henley report provides the following table.

Year No. of millionaires that migrated

2013 51,000

2014 57,000

2015 64,000

2016 82,000

2017 95,000

2018 108,000

2019 110,000

2020Covid 12,000

2021Covid 25,000

2022 84,000

2023 120,000

2024 134,000

2025Provisional 142,000

2026Forecast 165,000

• 'Millionaires' or 'HNWIs' refer to individuals with liquid investable wealth of USD 1 million or more. Figures rounded to the nearest 1,000.

Source: New World Wealth

From 51,000 in 2013, the number of migrating millionaires is expected to touch 142,000 in 2025, and 165,000 in 2026.

India witnesses a net migration of 3,500 millionaires in 2025, but this is lower than the net millionaire migration 4,200 in 2024. The 2025 number is lower than that for 2024 for China, as well, although the absolute numbers are much larger for China: from a net millionaire loss of 15,200 in 2024, to 7,800 this year. Both India and China see millionaires move in to take advantage of new wealth creation opportunities, particularly in tech, but are still net losers of millionaires.

What are the policy implications? What can a country do retain its millionaires at home, investing, innovating, creating jobs and incomes, boosting stock markets, and paying taxes?

When it comes to the pull or push effect of tax, many might be tempted to suggest, a race to the bottom. That would be inadvisable. The most sensible way to tax the world’s rich is to offer them reasonably low and stable rates at home, a healthy dose of governance in return, and the prospect of international collaboration to eliminate tax havens.

Until the present US administration torpedoed the move, the world had been moving to a coordinated international effort to levy a minimum tax of 15% on businesses, to combat the disease the OECD has dubbed BEPS – base erosion and profit shifting. A similar effort is required to create a minimum tax on personal incomes, wherever a millionaire goes.

But the key factor here is governance. India offers all kinds of incentives to boost manufacturing in India. But India’s infrastructure building is constrained by a missing bond market. And according to investment veteran Nilesh Shah, who spoke to Basis Point Insight on the subject recently, the inordinate delay in settling legal disputes is a major factor in keeping the Indian corporate bond market stunted. Contract enforcement routinely comes in as one of the worst facets of India’s business ecosystem, in international comparisons of the ease of doing business.

However, there is another factor to consider as well. Sectarian politics and rampant populism are gnawing away at India’s economic potential.

India’s dominant Hindu religion has traditionally been one of the most attuned to multicultural coexistence. According to its core philosophy of Advaita or non-duality of what would conventionally be called the creator and the creation, everything in the universe is a manifestation of Atman or the Ultimate Spirit. This leaves no room to despise another being, or recognize deviance at the level of theology, leading Vivekananda to proclaim that different religions are like different rivers that flow to the self-same ocean. This view permits the minimization of friction not only between people following different faiths, but also between people who follow radically different paths to spiritual equilibrium within the broader Hindu fold.

Sectarian politics infuses the poison of intolerance into this traditional culture of live and let live. This has rent the fabric of social cohesion, without which society cannot function nor the economy thrive.

Populism starves the state of resources that are desperately needed for productivity-boosting investment in social and physical infrastructure. India, for example, produces grain far in excess of requirements, thanks to ill-conceived and wasteful subsidy. India is preparing to convert 5.2 million tonnes of rice into ethanol, thanks to the accumulation of unwanted grain in government stocks. There are all kinds of different give-aways at the state level, as well.

Sensible politics alone can salvage social cohesion and fiscal sense on productive use of scarce resources.

Politics that will promote coexistence of different groups of people in dignity, permitting them to turn their energies to economic activity, and generate good governance, besides, is what will tackle the problem of millionaire flight as well.